Artificial Intelligence: A Seismic Secular Growth Opportunity

Published on August 31, 2023

Artificial intelligence (AI) has been top-of-mind for investors for much of 2023, fueling a strong rally in the S&P 500. While it may take time for AI to have a similar impact on small cap stocks, we share the market’s enthusiasm and believe AI has the potential to become one of the most disruptive secular growth trends ever.

After a challenging year for growth stocks in 2022 and the failure of several regional banks earlier this year, investor attention has shifted significantly towards the potential of AI. The adoption of OpenAI's ChatGPT, which now boasts over 100 million monthly users and 1.8 billion visitors per month, has triggered a surge of interest in generative AI. While not new, the recent buzz surrounding the technology has been driven by the simplicity of new user interfaces, enabling the creation of high-quality text, graphics, and videos in mere seconds.

Leading large cap technology companies such as Apple, Google, Meta, Microsoft, and Nvidia have been aggressively investing in AI and have experienced strong stock price appreciation as AI hype appears to be at an all-time high. Microsoft, through its partnership with OpenAI, has been a clear beneficiary, and Google has also made rapid strides, launching its competitive product called Bard. Google is also experimenting with embedding AI-powered overviews in search results.

AI is still in the early stages of its lifecycle, so it is too soon to evaluate its real economic impact. Nonetheless, we believe AI has the potential to be among the most disruptive secular growth trends of all time.

AI Is a Foundational Technology

As investors focused on growth stocks, we spend a lot of time analyzing secular growth trends – structural economic changes that create durable shifts in demand. In 2019 we published a blog that describes our view of the secular growth landscape, which we divide into three primary categories: (1) Foundational Technology (2) Replacement Product, Existing Market (3) New Product, New Market. In our view, AI fits into the first type, which we feel is the most important. Below is a small excerpt from our original piece that explains the concept:

Some technological innovations are so impactful that they not only generate their own wave of demand, but they also create a foundation upon which other businesses can grow.

While applications like ChatGPT are important, we believe the real value of AI lies in its utility as a platform. Just as the internet gave rise to eCommerce and social media, and smart phones enabled ridesharing and on-demand dining, we expect AI will follow a similar trajectory, spawning businesses that have a comparable influence on how we live and work.

Thus far one of the biggest winners has been Nvidia, a semiconductor company that produces critical graphics processing units (GPUs) that power AI applications, which recently reported $13.5 billion in Q2 revenues, up over 100% from a year ago. In our view Nvidia’s success is just the beginning, as AI is a portable technology that can be used in almost any industry. As entrepreneurs discover creative ways to deploy AI, we expect to see a wave of promising new companies that should create excellent small cap opportunities.

AI Has Broad Commercial Applicability

At this point, the full range of AI’s capabilities has yet to be determined, but we share the prevailing view that the possibilities seem vast. In fact, DeepMind, a pioneering AI research laboratory that is now part of Google, aims to "solve intelligence and then use that to solve everything else."

While that statement may be a bit grandiose, technology visionary (and pragmatist) Bill Gates is similarly bullish. In a recent blog post titled "The Age of AI has Begun," Gates stated that "the development of AI is as fundamental as the creation of the microprocessor, the personal computer, the Internet, and the mobile phone. It will change the way people work, learn, travel, get healthcare, and communicate with each other. Entire industries will reorient around it. Businesses will distinguish themselves by how well they use it." Microsoft has already reported that developers using GitHub Copilot, an AI tool that turns natural language prompts into coding suggestions, complete tasks 55% faster than those who do not use it.

Here are a few other examples of how AI could impact business going forward, courtesy of ChatGPT:

- Enhanced Efficiency and Productivity: AI-powered automation and machine learning algorithms have the potential to optimize operations, reduce costs, and improve productivity across various industries, from manufacturing to logistics.

- Data-Driven Decision Making: AI algorithms can analyze vast amounts of data and extract valuable insights, empowering businesses, health care providers, and government organizations to make informed decisions. This data-centric approach fosters innovation and efficiency while also driving competitive advantages.

- Personalized Experiences: AI's ability to analyze individual preferences and behaviors enables personalized customer experiences. Examples include recommendation systems for e-commerce platforms and personalized healthcare solutions that tailor treatments based on patient data.

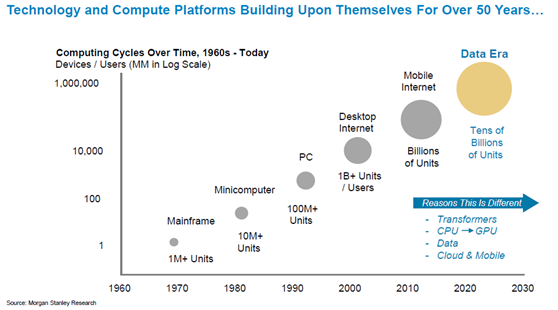

As the chart below shows, we are on the brink of a new computing era driven by AI, following previous technology cycles such as the mainframe, personal computing, and cell phone.

In economics, Nobel prize winner Robert Solow created the Solow growth model, which measures long-term economic growth as a function of capital, labor, and technological progress. The model concludes that capital alone does not drive long-term economic growth, and there are diminishing returns to labor. Crucially, the growth of output per worker is determined solely by the rate of technological progress. The potential of AI is enormous because it promises to enhance productivity significantly.

How We Are Investing in AI Today

When evaluating AI, we believe investors should consider three critical factors:

- Avoid businesses that are easily replaced by AI: Chegg, an online education company, mentioned in a recent earnings call that it experienced a significant spike in student interest in ChatGPT, which subsequently impacted its new customer growth rate, resulting in a substantial decline in the company's stock. With rapidly evolving technologies, companies must adapt quickly or risk extinction.

- Identify long-term AI winners: Beyond Google, Microsoft, and Nvidia, we believe the list of beneficiaries of AI will expand to smaller, emerging companies over time. One area we like is semiconductor capital equipment companies, which manufacture equipment crucial to the production of chips like GPUs for Nvidia. AMD’s CEO Lisa Su recently projected that the data center AI accelerator market will grow from $30 billion to over $150 billion in 2027, over a 50% compound annual growth rate. The increasing demand for larger chips for AI and the rise in manufacturing complexity bode well for long-term growth in this sector. We also expect existing businesses that can embed AI into workflows and emerging companies which create new technologies and AI-specific apps (e.g., vector databases tailored for large language models) to benefit.

- Ignore short-term hype: While Nvidia is a clear beneficiary of AI, such companies are rare. Many AI pretenders should be avoided. We like to see companies with real technology adoption and steady progress towards specific revenue and profit targets.

Looking Ahead

Although setbacks are inevitable, we firmly believe that AI is here to stay and will usher in a new era of computing. Just as Intel capitalized on the PC, Apple capitalized on the smartphone, and Amazon capitalized on cloud computing, this major technological shift offers the potential for significant value creation for companies and investors.

Investors should be cautious of hype while seeking exposure to category-defining companies in this new era. AI and other emerging technologies will bring forth many exciting new companies, but it will take time to determine the winners and losers. Waiting can often yield a second-mover advantage in technology. Apple, Meta, and Google were not the pioneers in their respective markets, but they came to dominate them.

As investors based in San Francisco with a keen interest in emerging technologies, we look forward to closely monitoring developments. We are excited about the prospect of new technology paradigms such as AI and its impact on long-term returns in the future.

Opinions expressed are those of the author, are subject to change at any time, are not guaranteed, and should not be considered investment advice.

References to specific companies, market sectors, or investment themes herein do not constitute recommendations to buy or sell any particular securities.

There can be no assurance that any specific security, strategy, or product referenced directly or indirectly in this commentary will be profitable in the future or suitable for your financial circumstances. Due to various factors, including changes to market conditions and/or applicable laws, this content may no longer reflect our current advice or opinion. You should not assume any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Osterweis Capital Management.