Focus on Dividend Growth, Not Dividend Yield

Published on July 13, 2023

Dividends have historically played an important role in shareholder returns. In our view, companies that pay growing cash dividends also tend to reinvest in themselves, which can drive growth in cash flow and provide attractive returns with less volatility over time.

Back to Basics

As part of our Quality Growth approach to equity investing, we tend to gravitate towards companies that pay growing cash dividends and have a long history of doing so. This is because companies that pay stable and growing dividends often can do so because of a durable competitive advantage that enables a long runway of profitable growth. These companies also exhibit healthy underlying fundamentals throughout the economic cycle, generate robust cash flow, and maintain sound balance sheets. And companies that care about sustainably growing cash dividends tend to have boards and management teams that think about the long term with an eye towards preserving and prudently growing cash flows over time.

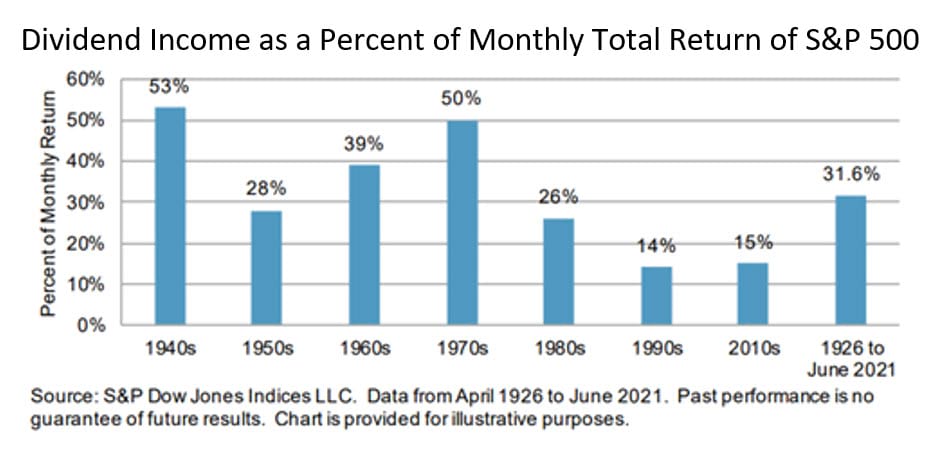

Historically, dividends have played an important role in overall shareholder returns. In fact, a study from S&P Global demonstrates that 32% of shareholder returns in the S&P 500 were generated by dividends from 1926 through June 2021. In some periods, when markets swoon, dividends account for 50% or more of overall S&P 500 returns, as was the case in the three decades of the 1940s, 1970s, and 2000s.

An important element in the contribution of returns from dividends stems from the reinvestment of the dividends, generating incremental compounding that can be very powerful over time.

We Emphasize Growth of Dividends and Focus Less on Yield

It is important to emphasize that we do not just seek companies that pay significant dividends. In fact, our companies often pay out as little as 10-30% of their annual free cash flow generation in the form of dividends. Dividend growth companies tend to retain significant cash flow for reinvestment, perhaps in the form of future acquisitions, which can drive future growth in cash flows. This cash flow growth in turn enables future dividend growth. And leaving room for opportunistic share repurchase can enable very powerful shareholder value creation over time.

We believe a long runway for sustainable growth in free cash flow is the critical element, not the payment of large dividends today. Companies that can sustainably grow their dividends tend to benefit from secular industry tailwinds, pricing power, and/or recurring demand growth. These are exactly the types of businesses we have always sought to invest in, particularly when we catch them at an attractive valuation and/or an inflection point.

Companies that pay out all of their free cash in the form of dividends may carry a high dividend yield that looks attractive at first glance. However, this means the company either has no opportunity to reinvest to drive future growth and thus is in cash harvest mode or will have to use outside capital to reinvest or repurchase shares. Thus, counterintuitively, high dividend yield stocks may often signal problems ahead, while low dividend payors with the ability to grow dividends may be much more attractive.

By selecting companies that both have long histories of paying dividends and growing these dividends annually, we seek to capture the best of both “value” and “growth” investing. These companies have sustainable and enduring growth, but they generate cash flow in excess of their reinvestment opportunities. Over time, this combination can be extraordinarily powerful and significantly benefit portfolios.

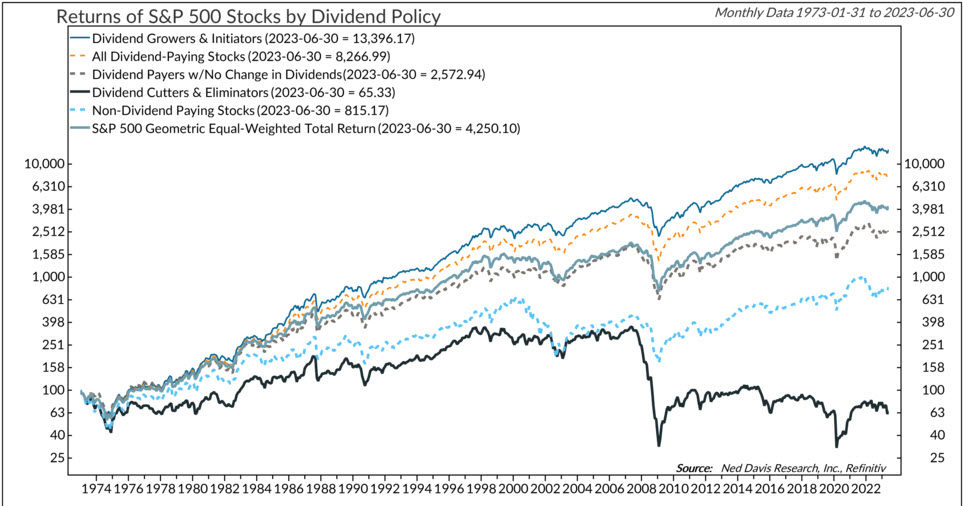

A recent study by Ned Davis Research shows that dividend growers tend to meaningfully outperform the market over time. This study has been updated through multiple economic and market cycles and consistently shows that dividend growers outperform.

Indices are unmanaged and not available for direct investment. For illustrative purposes only.

The Best of Both Worlds: Less Volatility, Higher Returns

Perhaps the most compelling attribute of companies with long histories of growing dividends is the fact that these businesses tend to exhibit attractive returns with less volatility over time. In fact, from January 1990 to June 2021, a basket of companies with the longest sustained histories of dividend growth both outperformed the broader S&P 500 index and saw less price volatility, resulting in a higher Sharpe ratio for the dividend paying basket. Specifically, the dividend paying basket outperformed significantly during drawdowns while performing roughly in line with the market during periods of broad advances in equities. This lower volatility outperformance is not a coincidence — we believe it results directly from the better underlying business performance and better balance sheets characterizing these companies.

Tying it Together

As always, we continue to seek investment opportunities in great or improving businesses at attractive valuations and inflection points. Emphasizing companies that pay growing dividends and have a long history of doing so is just another flavor of that approach, and we view the current market environment as ripe with opportunities in this area.

Nael Fakhry

Co-Chief Investment Officer – Core Equity

This commentary contains the current opinions of the authors as of the date above which are subject to change at any time, are not guaranteed, and should not be considered investment advice. This commentary has been distributed for informational purposes only and is not a recommendation or offer of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but is not guaranteed.

No part of this article may be reproduced in any form, or referred to in any other publication, without the express written permission of Osterweis Capital Management.

There can be no assurance that any specific security, strategy, or product referenced directly or indirectly in this commentary will be profitable in the future or suitable for your financial circumstances. Due to various factors, including changes to market conditions and/or applicable laws, this content may no longer reflect our current advice or opinion. You should not assume any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Osterweis Capital Management

The S&P 500 Index is an unmanaged index that is widely regarded as the standard for measuring large-cap U.S. stock market performance.

Free cash flow represents the cash that a company is able to generate after laying out the money required to maintain and expand the company’s asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value.

The Sharpe Ratio represents the added value over the risk-free rate per unit of volatility risk.

Yield is the income return on an investment, such as the interest or dividends received from holding a particular security.