Steepening the (Adoption) Curve: Covid-19 and Digital Transformation

Published on July 8, 2020

In the era of social distancing, technology has become even more integrated into our personal and professional lives. We believe this trend will persist even after the pandemic passes, and we expect it will particularly benefit firms that support remote working arrangements and eCommerce, two areas where we anticipate accelerating adoption and sustained growth.

Despite the massive decline in economic activity caused by the coronavirus, technology stocks have rallied since hitting their low in March. At first glance this strong performance may seem unwarranted, but we believe the growth makes perfect sense. As we have written previously, the economy was already in the midst of a digital transformation before Covid-19, and social distancing has significantly accelerated the process.

The pandemic has also broadened the scope of the transformation. Not only have industry leaders like Amazon, Facebook, and Netflix prospered as people have opted for the safety of home delivery and virtual interactions, but smaller, disruptive tech firms that support the expanding digital ecosystem have also grown substantially. In addition, social distancing has introduced challenges that not even Silicon Valley could have predicted, and it has created a need for solutions that did not exist before the pandemic.

Technology Has Moved Into the Mainstream

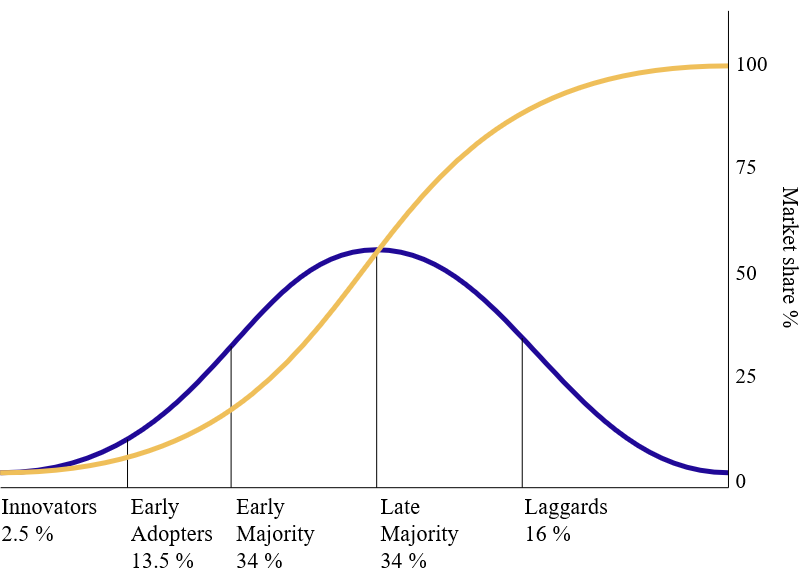

We believe the pandemic has fundamentally changed society’s attitude about technology, and we expect the shift will be lasting and durable. In our view, Everett Rogers' “Diffusion of Innovations” theory provides a useful framework to understand what is happening. According to Rogers, society can be divided into five basic categories that define an individual’s (or organization’s) likelihood to adopt new technology: innovators, early adopters, early majority, late majority, and laggards.

Source: Rogers, E. (1962) Diffusion of innovations. Free Press, London, NY, USA

The theory states that adoption tends to move through these cohorts sequentially, like a domino effect. Each group analyzes the experience of the previous group to decide whether to become adopters themselves. If the feedback is positive, the cycle progresses, and the cumulative adoption rate continues to climb (as shown by the yellow line in the above diagram.)

In our view, the pandemic radically accelerated this process, as both consumers and businesses had little choice but to embrace technological solutions. In first quarter earnings calls, CEOs from across the industry consistently spoke about accelerating customer adoption, confirming that the dominoes were falling much faster than expected. Satya Nadella, Microsoft’s CEO, said, “We’ve seen two years’ worth of digital transformation in two months.” Likewise, JPMorgan recently surveyed 130 CIOs about the effect of Covid-19, and 79% of respondents agreed that it will act as a forcing function to make them digitally transform faster than they had planned.

As the pandemic passes, adoption rates may normalize, but we believe that the post-pandemic level of market penetration will be substantially higher than pre-pandemic levels. Niche technologies that would otherwise have been the province of “innovators” and “early adopters” have been propelled into the “early majority” and “late majority” categories well ahead of schedule, and established technologies have been able to reach the laggards.

According to Diffusion Theory, once a technology penetrates the “early majority” cohort, a tipping point is reached and adoption rates increase rapidly. In our view, the events of the past few months have pushed a wide range of technologies into this group, and these are the firms we believe will be the best investment opportunities going forward.

Two Key Growth Areas: Remote Work and eCommerce

Two particular areas within technology that we expect to experience substantial growth are remote working arrangements and eCommerce. The pandemic has allowed both employers and employees to appreciate the benefits of a distributed workforce, and we anticipate that some form of telecommuting will become the new normal. Similarly, eCommerce, which was already quite popular, will continue to grow as a result of the pandemic, as both consumers and businesses have become accustomed to the convenience and efficiency of online shopping.

We have always believed the best investment opportunities arise when an industry experiences a disruptive transformation, and we believe this is such a moment for firms that support remote work and eCommerce.

Work from Anywhere

Prior to the coronavirus, remote working arrangements were almost uniformly the exception rather than the rule. Attitudes and policies varied by company, but most organizations preferred staff members to be on site.

Covid-19 upended the status quo almost overnight. A recent survey of 1,500 hiring managers from Upwork, an online platform that connects employers and freelancers, provides some concrete data around the change. According to the report, “the share of remote workers in the U.S. has quadrupled to nearly 50% of the nation’s workforce” since social distancing began.

Perhaps more importantly, the survey also revealed that:

- 56% of hiring managers feel that the shift to remote work has gone better than expected, while only one in ten feel it has gone worse than expected.

- The expected growth rate of full-time remote work over the next five years has doubled, from 30% to 65%.

- The single biggest drawback is technological issues, a problem that is likely a result of the rapid and unplanned shift and one that would be mitigated over time.

A separate survey by Buffer, a software company that develops social media tools, analyzed employee attitudes about telecommuting. They asked nearly 2,500 remote workers about their experience, and 99% said they would like to work remotely at least some of the time for the rest of their careers.

In other words, both employers and employees agree that remote work is here to stay. In fact, several large technology firms have already come forward to say that their employees can work remotely indefinitely. Twitter is leading the way, with CEO Jack Dorsey declaring, “If our employees are in a role and situation that enables them to work from home and they want to continue to do so forever, we will make that happen.” Facebook has taken a similar long-term view. In a recent interview, CEO Mark Zuckerberg said, “Over the next five to ten years, I think we could get to about half of the company working remotely permanently.”

All of this suggests that the infrastructure required to support remote work will continue to be in high demand for the foreseeable future. In the meantime, companies in this space have seen revenues surge and multiples expand, which is giving some investors pause – particularly those who are skeptical about the long-term viability of telecommuting. We do not share these concerns. On the contrary, we believe that the higher valuations make sense given that the technology to support remote work has become indispensable.

Below we explore two firms from our portfolio that we expect to benefit from the growth in telecommuting.

Bandwidth Inc.(BAND)

Bandwidth is a software firm that sells cloud-based communications technology, also known as a communications platform as a service (CPaaS). The company develops white-labeled components (e.g., voice, messaging, 911 access) that other firms can integrate into their proprietary communications systems and rebrand as their own. For example, Zoom, the online video conferencing platform, uses Bandwidth’s voice technology to support its audio infrastructure.

Naturally, the explosive growth of Zoom has been a material tailwind for Bandwidth. In December of 2019, Zoom had 10 million daily meeting participants. As of late April, the company was hosting 300 million daily participants. Beyond its relationship with Zoom, Bandwidth also powers communications for large technology firms like Microsoft and Google. We believe the company is extremely well-positioned to benefit from a longer-term shift to remote working and increased video conferencing, as the company develops essential building blocks for digital communication.

As an aside, Bandwidth and Zoom are both great examples of how the pandemic has not only accelerated technology adoption, but also been a catalyst for innovation. Zoom was originally developed as an enterprise application for businesses to communicate with other businesses, but thanks to Covid-19 it has evolved into an essential tool for schools, church groups, and social events. That shift also benefits Bandwidth.

Five9 Inc. (FIVN)

Five9 sells cloud-based contact center software that allows service reps to interact with customers through a variety of communications channels. They have developed a comprehensive end-to-end solution that scales to meet the needs of any organization and can be easily deployed across a remote workforce. Before Covid-19 the company was already growing market share by displacing legacy, on-premise systems in a $24 billion market which was only 10-15% penetrated by cloud software.

Since social distancing started, the company has seen demand surge, as the Five9 platform easily enables service reps to work remotely. Furthermore, Five9’s software provides customers with extensive monitoring and reporting capabilities, which reduces the importance of employees sitting in the same physical location as management. Many organizations will likely take advantage of the opportunity to reduce office space to save costs, as agents can work effectively from home. Recent partnerships with both Zoom and AT&T are a strong validation of Five9’s capabilities and growth opportunity.

Expanded eCommerce

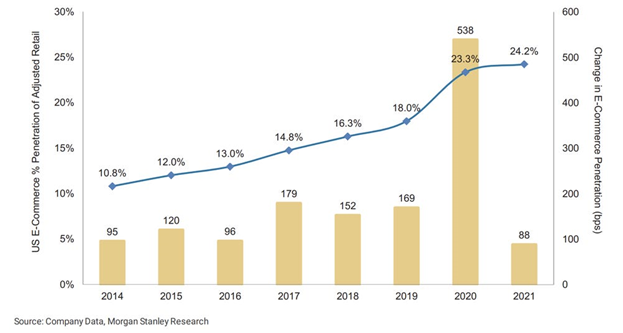

eCommerce was an integral part of the economy long before the pandemic started, and it was growing at a healthy pace. Nonetheless, the pandemic was a transformative event. In a recent report, Morgan Stanley estimated that ~2 years of eCommerce adoption was pulled forward in 2020. This is part of a longer-term trend as eCommerce penetration has more than doubled from ~10% in 2014 to 23% in 2020.

During the peak of the sheltering-in-place experience, with over 300 million Americans stuck at home, eCommerce became the country’s primary purchasing method. Not only did the proportion of online shopping increase as a percentage of total retail activity, but services that were previously rendered in person became virtualized. The biggest shift was in the delivery of health care – demand for telemedicine surged as both physicians and patients tried to limit in person visits to help contain the spread of the virus. Education also moved online for students at all levels, as schools closed around the country. Professional services also went digital, as scores of newly unemployed white-collar workers turned to online marketplaces to find work.

We believe that many of these behavioral changes will remain in place for years to come. For example, online grocery shopping doubled from 20 million U.S. customers in February (pre-Covid) to 40 million in April. Now that both the grocery providers and customers have become comfortable with the process, there is little doubt that many will continue to order their groceries online. Another survey by JPMorgan confirms an upward inflection in online grocery not just for non-perishable goods, but perishable goods as well, “indicating consumers’ prior preference for buying fresh in-store has deteriorated.” JP Morgan recently raised its long-term U.S. eCommerce penetration forecast to 35-40%.

Below we look at two firms from our portfolio that we expect to benefit from the increased appetite for eCommerce.

Teladoc Health, Inc. (TDOC)

Teladoc is a global virtual health care provider. The company offers a comprehensive suite of virtual medical services, and not surprisingly patient demand grew rapidly as a result of Covid-19. During the first quarter of 2020, year-over-year visits increased 92% to over 2 million. Revenues grew 41% to $180 million over the same period. Going forward, the company estimates that visits for the full year in 2020 will be between 8-9 million, and they are expecting full year revenues of $800-$825 million.

Prior to the pandemic, telemedicine was mostly an afterthought – most people were either unaware it existed or simply preferred going to the doctor in person. But now that so many patients have experienced it first-hand, we believe adoption will continue to accelerate as virtual visits are far more convenient than physical visits, particularly for simple conditions. Moreover, as a larger share of the workforce is working from home, it will be easier for patients to have private conversations – which could be challenging in an office setting.

Chegg, Inc. (CHGG)

Chegg is an education technology company that provides digital and physical textbook rentals, online tutoring, and other student services. Demand for online educational resources spiked during the pandemic, as most schools and colleges suspended in-person instruction. Chegg’s subscriber business grew 35% in the most recent quarter, as did its top line revenue.

CEO Dan Rosenweig believes that Covid-19 has pulled forward the shift to online learning, possibly by several years, as there is an even greater need for high-quality, low-cost online education. With many students and educators facing uncertainty about the upcoming academic year, Chegg finds itself in conversations with entire state school systems about how it can provide more support. Even as schools re-open, we expect online education will continue to play a strong role in supplementing (and in some cases, replacing) traditional brick and mortar education.

Looking Ahead

In this piece we have focused on two areas of the economy that we believe will create lasting opportunities for investors, but we are confident additional secular growth trends will emerge. Global pandemics are extremely rare (fortunately), but one silver lining is that they are the type of event that can inspire a wave of innovation that leads to a new generation of disruptive technologies.

James Callinan, CFA

Chief Investment Officer – Small Cap Growth

Bryan Wong, CFA

Vice President & Portfolio Manager - Small Cap Growth

Small Cap Growth Composite (as of 12/31/25)

| QTD | YTD | 1 YR | 3 YR | 5 YR | 7 YR | 10 YR | 15 YR | INCEP (7/1/2006) |

||

|---|---|---|---|---|---|---|---|---|---|---|

| Small Cap Growth Composite (gross) | 3.48% | 1.53% | 1.53% | 16.40% | 2.30% | 15.16% | 14.68% | 14.85% | 13.80% | |

| Small Cap Growth Composite (net) | 3.24 | 0.60 | 0.60 | 15.33 | 1.35 | 14.09 | 13.59 | 13.74 | 12.70 | |

| Russell 2000 Growth Index | 1.22 | 13.01 | 13.01 | 15.59 | 3.18 | 10.59 | 9.57 | 9.94 | 8.66 | |

Past performance does not guarantee future results.

Rates of return for periods greater than one year are annualized. The information given for this composite is historic and should not be taken as an indication of future performance. Performance returns are presented both before and after the deduction of advisory fees. Portfolio returns are calculated using a time-weighted return method. Portfolio returns reflect the reinvestment of dividends and other income and the deduction of brokerage fees, other commissions if any, and foreign withholding taxes. For the period 10/1/2012-12/31/2015, gross and net portfolio returns reflect the deduction of custodial, administrative, audit, legal, operating, and other expenses. Composite returns are calculated monthly by weighting portfolio returns by the beginning market value. Net return calculation:

A. For the period 7/1/2006-3/31/2014, composite net returns reflect the monthly deduction of an annual model advisory fee of 1.00%:

A1. For the period 7/1/2006-9/30/2012, one or more accounts paid a fee higher than the 1.00% model fee. During this period, the composite net return using the model fee of 1.00% was 10.95%. The composite net return using actual fees paid was 10.61%.

A2. For the period 10/1/2012-3/31/2014, no account in the composite paid a fee higher than the 1.00% model fee.

C. From 1/1/2020 onward, the composite net return is calculated using actual advisory fees, including any applicable mutual fund fee waivers.

D. Our fees may vary between accounts due to portfolio size, client type, or other factors.

Performance for the periods 7/1/2006-9/30/2012 and 10/1/2012-3/31/2016 represents the results of portfolios managed by the investment team while at RS Investment Management Co. LLC and Callinan Asset Management LLC, respectively, and employing the same investment strategy being used at OCM.

The Russell 2000 Growth Index (Russell 2000G) is a market-capitalization-weighted index representing the small cap growth segment of U.S. equities.

Clients invested in separately managed emerging growth accounts are subject to various risks including potential loss of principal, general market risk, small and medium-sized company risk, foreign securities and emerging markets risk and default risk. For a complete discussion of the risks involved, please see our Form ADV Brochure and refer to Item 8.

The Small Cap Growth Composite includes all fee-paying separately managed accounts, limited partnerships, and mutual funds that are predominantly invested in a concentrated selection of the equity securities of small and medium capitalization companies that can rapidly grow revenues and earnings. Portfolios normally remain primarily invested in equity securities except in times of unusual market stress when a more defensive allocation may be deemed prudent. The non-equity portion may be invested in holdings such as cash, cash equivalents, short-term debt securities, mutual funds, and ETFs. The benchmark is the Russell 2000® Growth Index.

References to specific companies, market sectors, or investment themes herein do not constitute recommendations to buy or sell any particular securities.

There can be no assurance that any specific security, strategy, or product referenced directly or indirectly in this commentary will be profitable in the future or suitable for your financial circumstances. Due to various factors, including changes to market conditions and/or applicable laws, this content may no longer reflect our current advice or opinion. You should not assume any discussion or information contained herein serves as the receipt of, or as a substitute for, personalized investment advice from Osterweis Capital Management.

Holdings and sector allocations may change at any time due to ongoing portfolio management. You can view complete holdings for a representative account for the Osterweis Small Cap Growth strategy as of the most recent quarter end here.

Opinions expressed are those of the author, are subject to change at any time, are not guaranteed and should not be considered investment advice.

Holdings and allocations may change at any time due to ongoing portfolio management. References to specific investments should not be construed as a recommendation to buy or sell the securities. Current and future holdings are subject to risk.

Dividend payments are not guaranteed.

Return on equity is the amount of net income returned as a percentage of shareholders equity.